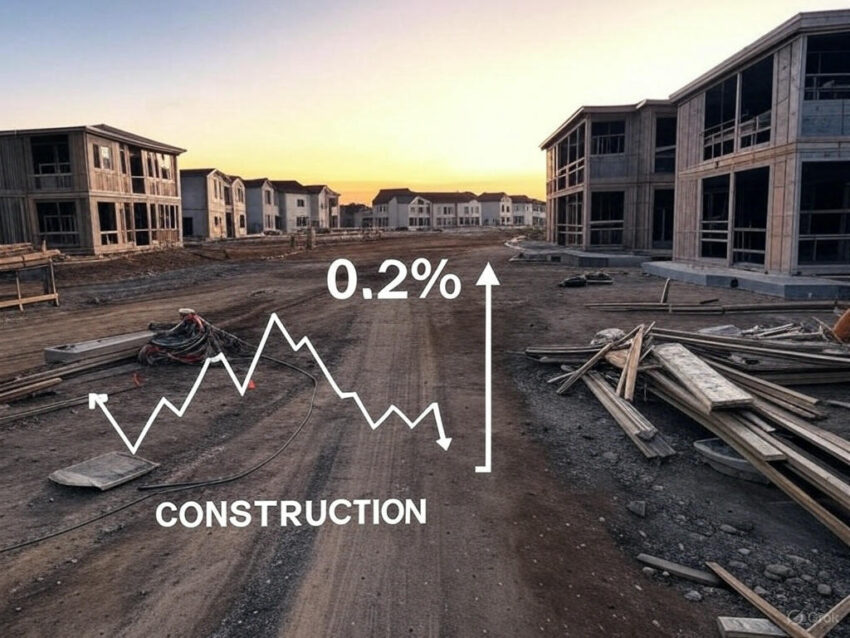

In January 2025, U.S. construction spending experienced a slight decrease from December 2024, illustrating a mild deceleration in the industry’s output. According to the latest data, total construction outlays declined by 0.2% to $2,192.5 billion, down from $2,196.0 billion in the previous month. Despite this monthly dip, the figures still reflect a 3.3% increase compared to January 2024, when spending stood at $2,122.2 billion. This performance, though positive on a year-over-year basis, fell short of market expectations which predicted a stable output with no change from the previous month.

The primary drag on January’s construction spending came from the residential sector, particularly noticeable in declines in multifamily projects and home improvements. Spending in multifamily construction decreased by 0.7%, while outlays on home improvements saw a more significant reduction of 1.5%. This downturn overshadowed the gains seen in private single-family home construction, which continued to grow, ticking up by 0.6%.

The slowdown in residential construction is concurrent with a broader cooling in the housing market, as evidenced by falling new home sales and a retreat in builder confidence. These trends suggest a cautious outlook among builders, likely influenced by rising costs and an uncertain economic environment, which could lead to a continued slowdown in residential construction spending in the months ahead.

On a more granular level, non-residential construction spending also showed varied results. Specific segments such as commercial and industrial development held steady, indicating some resilience in these areas despite the broader market challenges.

Regional variations also play a crucial role in understanding the dynamics of construction spending. For instance, areas heavily involved in tech and industrial sectors might continue to see robust investment, while regions with a cooling real estate market could experience further declines in construction outlays.

Looking forward, the construction industry faces several challenges, including supply chain disruptions, labor shortages, and rising material costs which could continue to impact project timelines and budgets. Despite these headwinds, opportunities for growth remain in sectors like renewable energy installations and infrastructure projects, driven by federal investments and policy supportive of modernizing the nation’s key assets.

As the year progresses, stakeholders in the construction sector will be closely monitoring economic indicators and policy changes that could influence spending trends. The adaptability and strategic adjustments made by businesses involved in construction will be key to navigating the uncertainties and leveraging potential growth opportunities ahead.