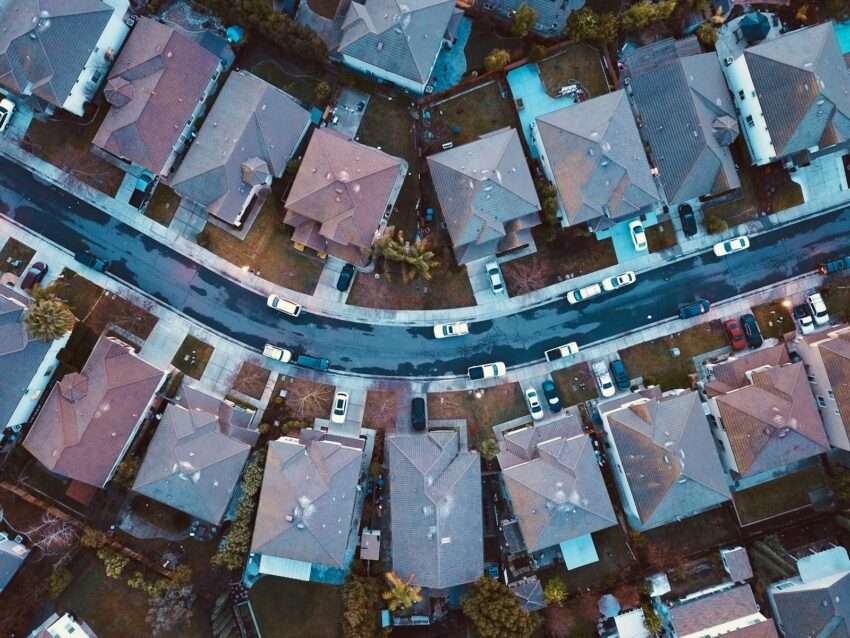

Mortgage rates rose Monday after Japan signaled a possible interest rate hike. The move pushed global bond yields higher and lifted the average 30 year fixed rate by 9 basis points. The shift halted a brief period of easing that had lowered rates to a four week low before Thanksgiving. The change comes as many San Gabriel Valley households search for stable financing in a tight housing market.

Global policy shift hits local buyers

Weaker retail sales and cooler inflation had helped rates drift lower in recent weeks. That trend reversed when Japan hinted at an end to its ultra loose policy. The announcement sparked a global bond sell off and pushed the ten year Treasury yield up about 7 basis points by the close. Lenders across Los Angeles County often track that benchmark when pricing long term mortgages, so the reaction reached buyers fast. Analysts say more volatility could arrive if Japan raises rates soon.

Local loan officers in El Monte and Baldwin Park say many clients paused applications on Monday. They cited concern that new rate swings could affect monthly payments. Several said they now coach buyers to expect wide moves from week to week. That uncertainty hits first time buyers hardest because even small rate jumps can cut buying power.

Housing affordability tightens in the region

The San Gabriel Valley already faces steep affordability barriers. Median home prices in cities such as Temple City and Arcadia outpace local incomes. A rise of 9 basis points does not shift the market on its own, but it adds weight to an already heavy load. Rising rates reduce the number of homes within reach for many families that depend on fixed budgets. Renters who hope to purchase often need stable conditions to plan down payments and closing costs.

Local agents say interest remains strong, yet they see more clients asking for lender credits or smaller homes. Some shoppers move searches toward South El Monte or parts of Rosemead where prices sit lower. A sustained climb in long term rates could speed that trend. If global markets stay unsettled, more buyers may wait for calmer conditions.

Community outlook in the months ahead

Regional housing groups watch long term rates closely because they guide affordability programs. Higher borrowing costs could limit how far local aid dollars stretch. Groups that track market data often publish updates to help buyers follow changing rates. The California Department of Real Estate offers resources for new homeowners at www.dre.ca.gov.

The global shift shows how distant policy decisions can shape daily life in the San Gabriel Valley. Families weighing home purchases may face more complex choices if long term rates keep climbing. Careful planning and clear guidance will matter as residents decide when to move forward in a changing market.